Improvements Declaration & Capital Gains Tax Information

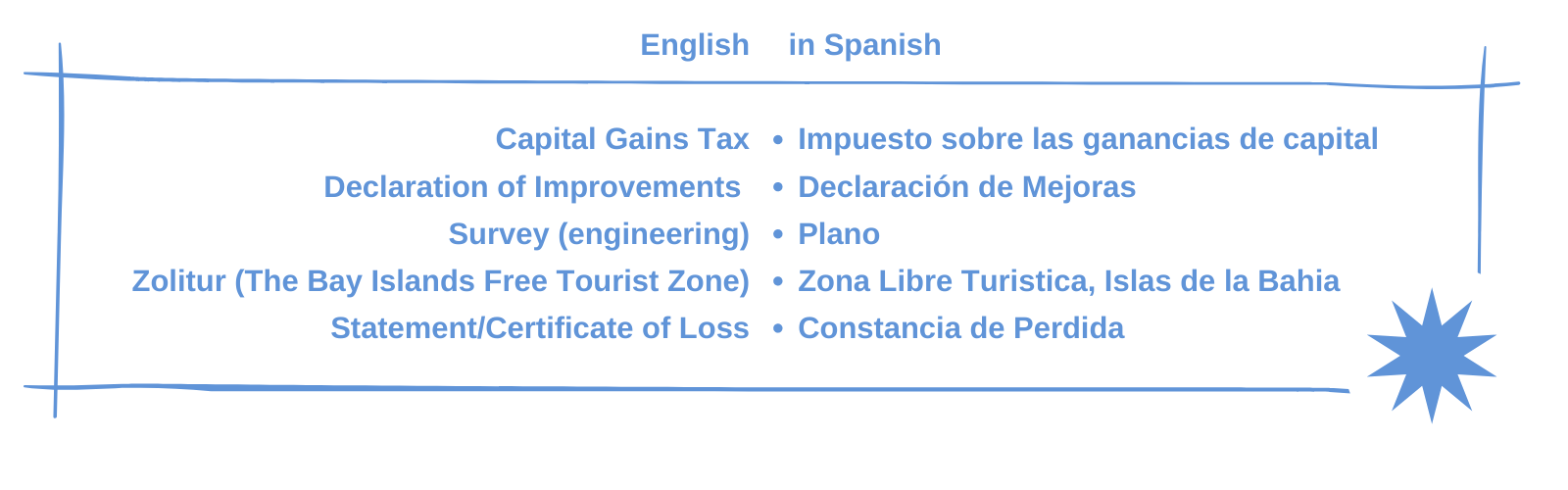

Did you purchase a piece of vacant land, built a home and are interested in selling it now? If so, here’s some information on making a “Declaration of Improvements” (Declaración de Mejoras) to reduce the “Capital Gains Tax” (Impuestos sobre las Ganancias de Capital) you’ll incur at the closing.

Please keep in mind that I am not a lawyer, and this is not legal advice. This is simply some information that you can verify and discuss with your attorney if you want to learn how you can reduce the amount of Capital Gains Tax you’ll pay upon selling your property. You’ll need to pay an attorney to make the declaration and file it with the Instituto de Propiedad en Roatan (Property Registry in Roatan).

What is a Declaration of Improvements?

An improvements declaration is a detailed description of the improvements you have made on a property such as an extension to a current structure or a home, pool, store, or hotel.

Why should I do a Declaration of Improvements?

Most often this declaration is made to reduce your future capital gains tax on selling your property. If you compare that to the current rate of capital gains tax at 4%, most often doing a declaration at about 1% total, will result in more money in your pocket when you sell your property. This may not be true with investments & homes under USD$80,000.

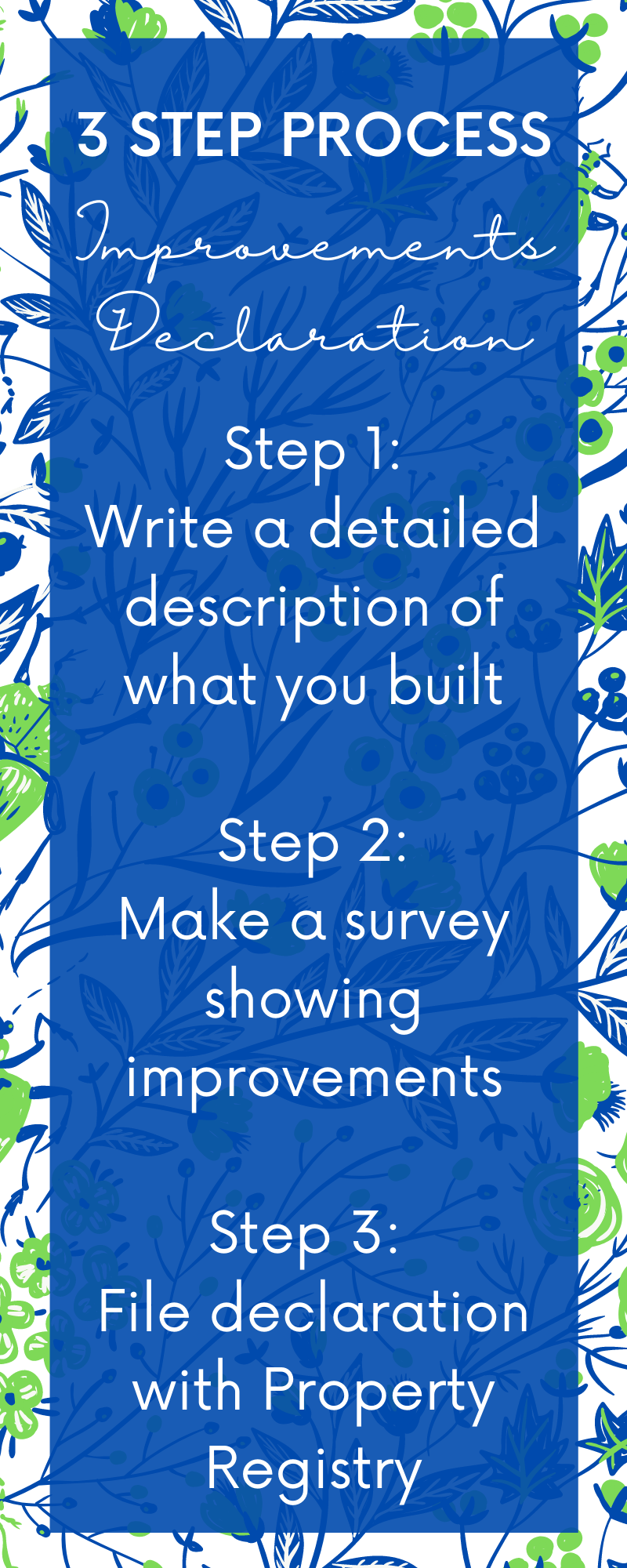

How do I make a Declaration of Improvements?

Step 1: Begin by making a detailed description of your improvements. Here are a few sample descriptions:

- 2 story home with 1000 sq. ft.

- Home set on concrete posts of 8 x 8 inches, 12 ft tall, with wooden walls & floor & an aluminum roof.

- Kitchen with granite countertops & ceramic tiled floor and island with 200 sq. ft.

- 2 bedrooms with wooden floors with dimensions 12 x 12 ft.

- 2 bathrooms with ceramic tiles with 100 sq. ft. each.

- Concrete platform below with 12 inches of concrete.

- 12,000 gallon water cistern made of concrete.

- Porch with 300 sq. ft, 10 x 30 ft.

- … and so on.

Also note that all legal documentation in Honduras is in spanish, so your declaration must be in Spanish.

Step 2: Hire a Honduran licensed engineer to take your building plans and have them placed on a survey (plano) of your land & improvements. Write a bullet point list of your improvements on the survey. Have the engineer sign and stamp the survey.

Please note that Honduras uses the metric system. So all improvements should be in meters/centimeters. You may use both in the description, but definitely metric should be in the declaration.

Step 3: Hire a Honduran licensed attorney to file your declaration with the Property Registry in Roatan. Usually the cost of the application is US $500 dollars minimum or 0.8% of the declared amount. Some attorneys include the Improvements Tax of 0.15% to the fees, others add it to the amount owing.

What should you know?

- Zolitur: Did you know that for real estate sales in the Bay Islands, your capital gains tax calculation needs to be done by Zolitur (The Bay Islands Free Tourist Zone – Zona Libre Turistica, Islas de la Bahía).

- The Honduran currency is the lempira currently between 23-24 lps/USD$1. If you purchased your land 20 years ago for $10,000, the amount will have been recorded in lempiras in your title deed. The lempira amount will be used in your calculation as the ‘initial investment’ amount if you sell today, therefore, due to the exchange rate, the initial investment will be different when converted to U.S. Dollars than what you paid previously.

- If you have a loss, you’ll still need a Certificate of Loss – Constancia de Perdida.

- How is the capital gains tax calculated?

This is a very simplified calculation:

- Take your current sales price.

- Subtract the original purchase price (in U.S. Dollars today)

- Subtract the registered improvements amount.

- Subtract your real estate commissions.

- Multiply the remainder by 4%.

- Arrive at an approximation of your capital gains calculation.